Lately I’ve gotten into the habit of collecting annuity-related memorabilia both to appreciate how the industry has evolved over the years and to have such items on hand for reference purposes.

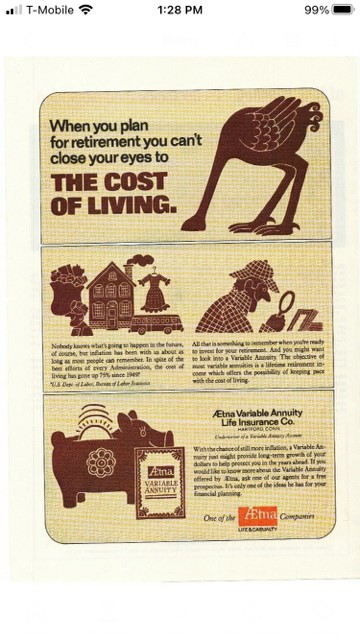

Which explains the photo accompanying this post: it’s a clipping of a 1974 magazine advertisement for Aetna variable annuities, which marketed their potential for investment growth to protect one’s retirement savings against the sky-high inflation of that time.

That message was in keeping with why the variable annuity was developed in the first place. The Teachers Insurance and Annuity Association of America came out with the first VA in 1952 to help its members in the education community allocate a portion of their savings to the stock market for greater appreciation than they were getting from their fixed annuities. That VA, known as the College Retirement Equity Fund, became the latter half of the TIAA-CREF acronym; a few years later contracts were introduced to the retail market.

In more recent decades the inflation protection sales pitch has taken a back seat to other annuity attributes. During bull markets, VA buyers were enamored with tax deferred growth in their equity sub-accounts. When the market tanked, clients flocked to guaranteed death and living benefits for protection.

I think that spiking inflation in the U.S. presents an opportunity for annuity insurers to come up with helpful solutions, provided they do so while avoiding taking on undue risks. In October, National Western Life announced it would be launching an index-linked income annuity with the potential for rising payments over time. I have seen similar products before, but to my knowledge they didn’t fare well.

It seems to me that annuity investors have ample help with asset accumulation already. National Western’s plan is to get the dialogue moving to the income side of the equation and that, admittedly, will take some work. Clients are still highly reluctant to annuitize and, perhaps more importantly, advisers consider annuitization as a hit to their profitability, because they view SPIA and DIA compensation schemes lackluster.

At the very least, over the near term I expect to see the theme of inflation protection come up more often in annuity prospectuses and marketing materials. Time will tell if these messages will resonate with advisers and clients; if they do, that would be a boon to the industry.