I know it’s late in the day on a Friday, but I figured I’d make a quick post that is appropriate for the season. It was a beautiful day up here in Portsmouth, complete with some intermittent light showers of rain.

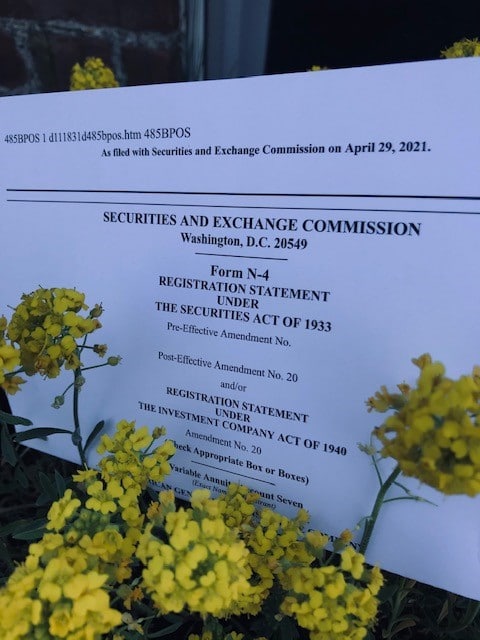

Which brings me to my topic: I am confident that my subscribers, who are closely following developments along the variable annuity product pipeline, know very well that April showers bring May prospectuses!

By now all the May 1 updates to existing products are in, and as usual, a few new ones made their debuts around the same time.

So what’s in bloom this season?

Well, as of my last count (see the April 30 edition of The Soleares Report), over half of VAs registered with the SEC this year have been I-share contracts, which, for the most part, are intended for sale through fee-based advisers.

I think insurers are stepping up their filing of I share VAs for two main reasons: 1) to appeal to the many advisers who have been migrating to the RIA channel and 2) to comply with the adviser best-interest regulations, developed in recent years, that will probably have the effect of discouraging sales of annuities with traditional up-front commissions.

There’s also been an uptick in filings of registered index-linked annuities (RILAs), which is not surprising. RILA sales have been soaring, and I can count at least two good reasons for that: 1) the product is meeting investor demand for downside protection while 2) filling the void left by VA guaranteed living benefits that have been closed to new sales.

One could argue that, on the fixed side, multi-year guarantee annuities (MYGAs) are appealing to risk-averse investors, even though crediting rates are not what they have been in years past. In combing through insurers’ 1Q21 financials, I noticed that MYGA sales for American Equity, traditionally an indexed annuity player, have been “off the chart” in recent quarters. I’ll cover more Q1 numbers in an upcoming report.

Over the near term I expect insurers to come out with annuities with the following attributes: low costs (to the client), modest guaranteed benefit risks (for the carrier), and sensitivity to new adviser standards (to appease regulators).

In closing, I’ll point out something that will be of interest to true annuity filing geeks like myself. Starting in late April, insurers began submitting VA summary prospectuses to the SEC using form 497VPI. These documents focus mainly on VA chassis basics, fees and expenses and the sub-account options. The filings are nice and concise, but if a client needs to get a full understanding of an optional death or living benefit, he/she will need to refer to the full prospectus. I imagine that the information in form 497VPI will evolve over time, and I will be interested to hear of adviser and client feedback on it.