Over time I have been adopting habits I think are characteristic of New England residents, because this transplanted New Yorker wants to fit in, as best I can.

I have resolved to purchase a copy of The Old Farmer’s Almanac each year. I see often see it for sale, whether in downtown Portsmouth gift shops, the local Ace Hardware, even at gas station convenience stores. The almanac is chock full of useful information for each day of the year: sunrises and sunsets, the movements of the stars, notable dates; plus there are recipes and pointers, stories, jokes, puzzles and anecdotes.

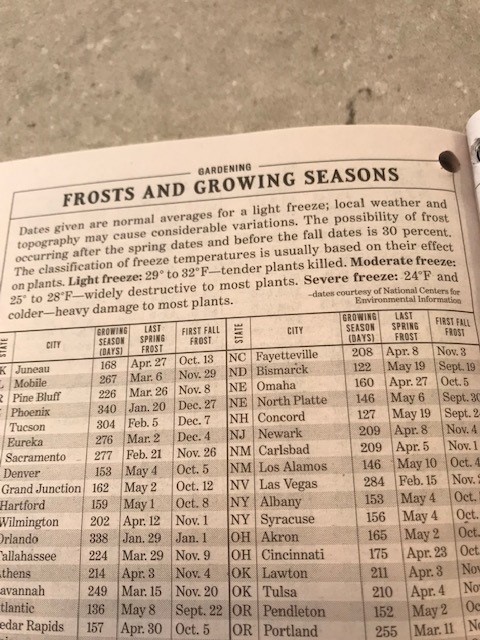

Recently while paging through the book, I discovered a “Frosts and Growing Seasons” section which listed the number of days between the last frost of spring and the first of autumn for selected cities and towns throughout the U.S.

It turns out that Concord, New Hampshire has a growing season of just 127 days! That’s in stark contrast to places like Phoenix, Arizona with 340 (the longest season I saw on the list), or Charleston, South Carolina, with 298. Suffice it to say, farmers up here must take advantage of all the warm days they can get!

Which brings me to our annuity industry. We are now entering the second quarter, which is typically the best in terms of sales production. A big reason for that, of course, is April tax time, when IRA holders make their annual contributions. Moreover, May not only brings prospectus updates, it tends to be the time when new products are introduced. I suspect that in Q2 many financial advisors seek to ramp up new business and close tickets before they take their summer break in Q3.

So, I would like to ask my industry readers: how long is your growing season? Is it short like up here in New Hampshire? Or is it long and languid like down south?